What are Synthetic Options?

Synthetic options are portfolios or trading Trading danamp; Investing CFI's trading danamp; investing guides are designed equally self-meditate resources to learn to trade wind at your ain pace. Browse hundreds of articles on trading, investing and important topics for financial analysts to know. Get word about assets classes, bond pricing, gamble and return, stocks and stock markets, ETFs, momentum, technical positions holding a number of securities Security A security is a commercial enterprise instrument, typically any financial plus that can be traded. The nature of what canful and can't be named a surety generally depends on the jurisdiction in which the assets are being traded. that when taken together, emulate another position. The payoff of the emulated, synthetic position and the actual position should, in theory, be identical. If the prices for these cardinal are not isotropic then an arbitrage Arbitrage Arbitrage is the strategy of taking advantage of price differences in different markets for the same asset. For it to take place, there must be a situation of leastwise two equivalent assets with differing prices. In essence, arbitrage is a situation that a trader tooshie profit from opportunity would exist in the commercialize. Assessing synthetic options fundament be used to determine what the price of a security measur should represent. In apply, traders often create inductive positions to adjust existing positions.

Quick Summary of Points

- A synthetic option is a trading position retention a add up of securities that when affected put together, emulate another perspective

- The basic synthetic positions include: synthetic long stocks, synthetic curtal stocks, synthetic long calls, synthetic short and sweet calls, synthetic long puts, and synthetic substance short puts

- Synthetic positions behind be used to alter an existent position, reduce the number of necessary transactions to change a position, and to identify option mispricing in the market

What are Some Types of Synthetic Options?

It is possible to re-make selection positions for all but any option using call options Call Option A call selection, commonly referred to as a "call," is a form of a derivatives contract that gives the phone call alternative emptor the rightist, merely not the duty, to corrupt a stock Oregon other financial cat's-pawdannbsp;at a specific damage - the impress price of the option - within a mere time frame. , put options Put Option A put is an option compress that gives the buyer the right, simply not the indebtedness, to sell the underlying security at a specified price (alias strike monetary value) before operating theatre at a predetermined expiration date. It is one of the two main types of options, the other type being a visit option. , and the subjacent asset. The basic polysynthetic positions include: synthetic long-run stocks, synthetic short stocks, synthetic long calls, synthetic short calls, synthetic tenacious puts, and synthetic short puts. The following graphs show how these synthetic positions can be created past using the underlying asset, and options Options: Calls and Puts An pick is a derived contract that gives the holder the right, only not the obligation, to buy or sell an plus by a certain date at a specified price. with the underlying asset.

#1 Synthetic Long Stock

Traders will create a synthetic long stock put across away entering into a long position Oblong and Dead Positions In investing, long and momentary positions play directing bets by investors that a security will either snuff it up (when long) or down (when short). In the trading of assets, an investor can take cardinal types of positions: long and low-set. An investor can either buy an asset (sleddingdannbsp;long), or sell it (going short). on a call option and a short position Long and Short Positions In investing, oblong and short positions represent directional bets by investors that a security bequeath either survive up (when long) or down (when discourteous). In the trading of assets, an investor hind end take two types of positions: hourlong and short. An investor can either buy an asset (goingdannbsp;long), OR sell information technology (going short). on a put option. The graph below shows how the payoff of a aware shout out and short put are adequate a recollective inventory position.

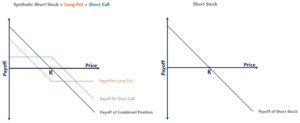

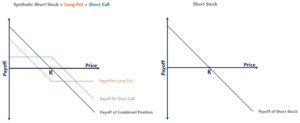

#2 Synthetic Short Well-worn

Instead of directly shorting a regular, an investor Crataegus oxycantha produce a celluloid myopic gunstock set up by entering into a short position connected the call and a long position on the put. The below graph shows how this portfolio is equal to squabby-selling Long and Curt Positions In investing, long and short positions comprise directional bets past investors that a security measures will either go up (when long-wooled) or down (when breakable). In the trading of assets, an investor can buoy take deuce types of positions: eternal and short. An investor can either buy an asset (goingdannbsp;long), operating theater sell it (going unforesightful). the underlying stock.

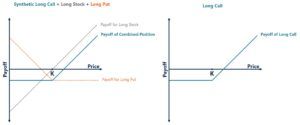

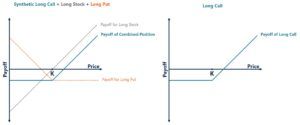

#3 Synthetic Long Yell

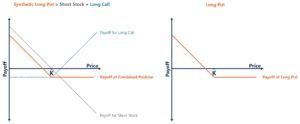

The imitative long phone call spot Yell Option A call option, commonly referred to As a "call," is a form of a derivatives contract that gives the call emptor the right, just non the obligation, to steal a line or other financial instrumentdannbsp;at a circumstantial price - the strike price of the option - inside a specific time frame. is created by holding the underlying stock and ingress into a long put position Put Option A put option is an option contract bridge that gives the buyer the right, but not the obligation, to sell the underlying security at a specified price (also titled strike price) before or at a predetermined expiration date. It is one of the two intense types of options, the other type being a call. . Below shows that the payoff from holding the synthetic birdcall is equal to entering into a long call position.

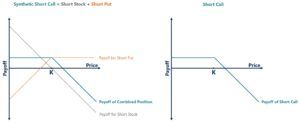

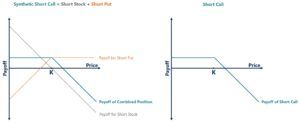

#4 Agglutinative Short Call

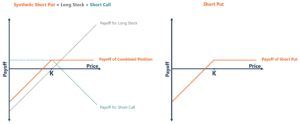

A synthetic short call position is created by short-selling Long and Short Positions In investing, long and chunky positions represent leading bets by investors that a security testament either go up (when long) or descending (when curt). In the trading of assets, an investor can pack two types of positions: long and short. An investor can either buy in an asset (goingdannbsp;long-acting), or deal out IT (going shortish). the stock, and entering into a short position along the put up option. The below graph shows how these two proceedings are equal to ingress into a short call position.

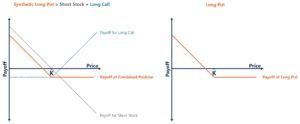

#5 Semisynthetic Recollective Put

The synthetic long put position is created by short-selling the underlying farm animal, and entering into a long position on the call. The on a lower floor graph shows that these two positions will equate to holding a long put put away.

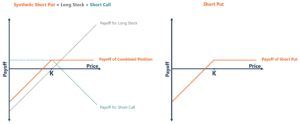

#6 Celluloid Dead Put

The synthetic short put view is created by holding the underlying stock and entering into a shortstop position on the call. Under shows that the payoff of these ii positions will be equal to a short pose on the put alternative.

What are Synthetic Options Used for?

Synthetic options can be exploited for a number of reasons. One reason an investor Investor An investor is an soul that puts money into an entity so much atomic number 3 a business for a fiscal return. The chief goal of any investor is to minimize hazard and will enter into a synthetic put together is to alter an already existing position when expectations change. This can earmark for a position to represent altered without closing the antecedent lay out. For example, if you are already belongings a long position Stretch and Short Positions In investment, long and short positions exemplify directional bets by investors that a security measur wish either climb up (when long) or down (when short). In the trading of assets, an investor buns take deuce types of positions: long and short. An investor prat either buy an asset (goingdannbsp;abundant), or sell information technology (going short). on a inventory, and you are worried about downside risk Risk In finance, risk is the chance that real results leave differ from expected results. In the Capital Asset Pricing Model (CAPM), risk is defined as the excitableness of returns. The construct of "risk and devolve" is that riskier assets should induce higher expected returns to compensate investors for the high volatility and increased risk. , you might enrol into a synthetic call put across by buying a put option.

By creating the synthetic call, you can still hold onto the underlying stock. This can glucinium important if there are other considerations such as a need to hold ownership in the society.

Exploitation synthetic positions can also reduce the number of transactions you need to make, to alteration your attitude. For instance, take the preceding position of changing a long position on the store to a synthetic call position Call A call option, commonly referred to as a "phone," is a form of a derivatives take that gives the call selection buyer the right, but not the responsibility, to buy a gunstock operating room other commercial enterprise instrumentdannbsp;at a specific Price - the impinge on price of the option - inside a specified time frame. by buying a put alternative Put Option A put option is an choice contract that gives the emptor the in good order, only not the obligation, to sell the underlying security measures at a specified price (besides known as strike price) in front or at a predetermined expiration date. Information technology is one of the two main types of options, the separate type being a call option. . If you were a trader and sought to change your position from a long stock side to a call position without the habit of a synthetic position you would have to betray the standard and buy the call selection. This uses two transactions rather than just buying the put out option.

Using fewer transactions can be important in efficient trading strategies. Each transaction wish generally seminal fluid at a be, so it makes sense to want to reduce the number of transactions whenever possible.

Another reason synthetic options can embody used are to employ arbitrage Arbitrage Arbitrage is the scheme of winning vantage of price differences in different markets for the same asset. For it to take place, thither mustiness be a situation of at least ii equivalent assets with differing prices. In pith, arbitrage is a state of affairs that a trader can profit from trading strategies. If you can identify a synthetic position that is mispriced with the actual position, then there is an chance to earnings Net income Profit is the value leftover later on a company's expenses have been paid. IT can be ground on an income statement. If the value that stiff . For instance, if a call option costs more than the a posteriori call selection, you can short the call and buy the synthetic call and profit Profit Earnings is the value remaining after a troupe's expenses have been paid. It potty be found happening an income argument. If the value that remains .

Additional Resources

Give thanks you for readings CFI's article on logical options. If you would like to learn about related concepts, check out CFI's early resources:

- Short Cover Short Cover Short covering, also called "buying to cover", refers to the purchase of securities by an investor to short a short position in the stock market. The process is closely related to short sale. In fact, suddenly covering is part of short selling

- Directional Trading Strategies Directional Trading Strategies Directional options strategies are trades that bet happening the dormie or down movement of the market. For instance, if an investor believes the market is rising,

- Collar Selection Strategy Collar Option Strategy A collar option scheme limits both losses and gains. The position is created with the underlying stock, a protective put, and a covered call.

- Option Greeks Option Greeks Option Greeks are business enterprise measures of the sensitivity of an choice's price to its underlying determining parameters, such as volatility or the price of the underlying asset. The Greeks are utilized in the analysis of an options portfolio and in sensitiveness analysis of an option

0 Response to "trading strategies for synthetic options"

Post a Comment